Therapy Deductible: What It Means and How It Affects Your Health Costs

When you hear therapy deductible, the amount you must pay for mental health services before your insurance starts covering part of the cost. Also known as mental health out-of-pocket threshold, it’s not just a number on a bill—it’s a real barrier that can stop people from getting help when they need it most. Many assume insurance means free therapy, but that’s not true. Before your plan kicks in, you’re responsible for paying the full cost of each session until you hit your deductible. This can mean $50, $100, or even $200 per visit, and it adds up fast—especially if you’re seeing a therapist weekly.

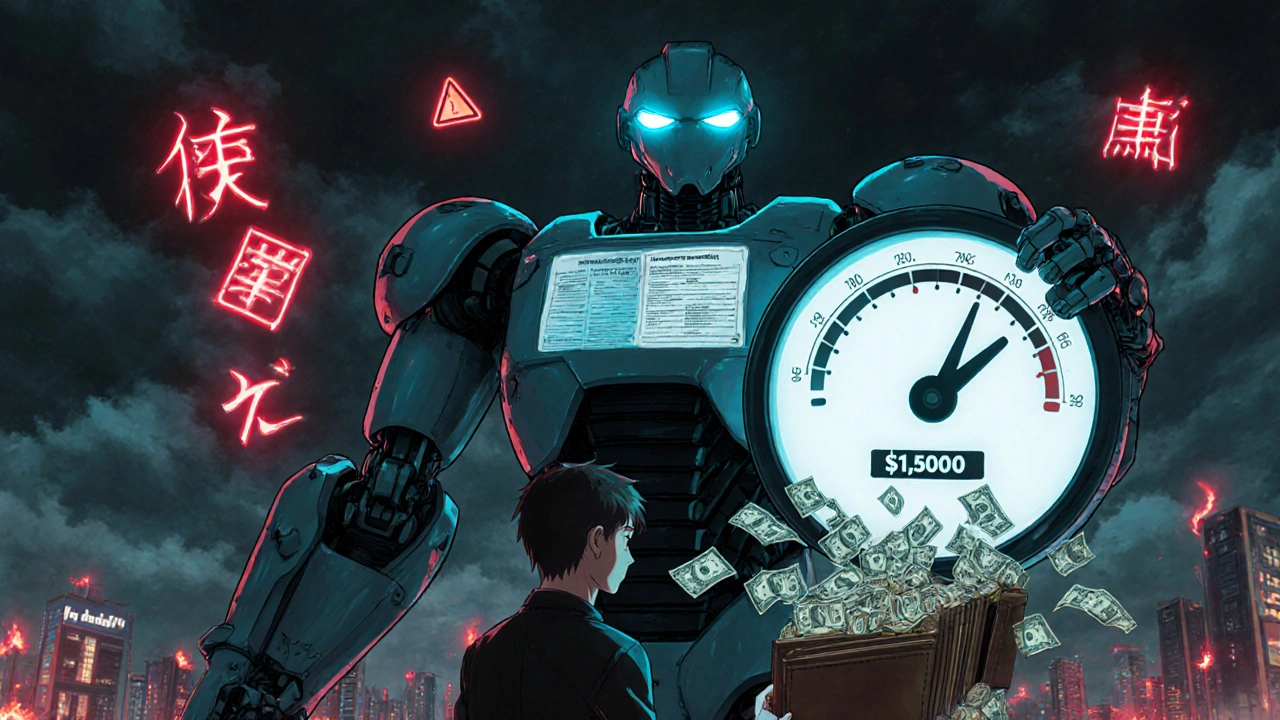

Your health insurance, the plan you get through work, the marketplace, or Medicaid/Medicare. Also known as medical coverage, it doesn’t treat therapy the same as a doctor’s visit. Some plans have separate deductibles for mental health, meaning you might pay $1,500 for therapy alone before coverage starts, even if your general medical deductible is already met. Others bundle it all together. And if your plan has high deductibles—common with cheaper monthly premiums—you could be paying thousands before your insurance helps. That’s why people with anxiety, depression, or PTSD often delay care. They can’t afford it. Or they don’t realize how much they’ll actually pay.

medical expenses, the total cost of treatments, medications, and services you pay for out of pocket. Also known as healthcare costs, it doesn’t stop at therapy. If you’re on medication, lab tests, or follow-ups, those costs usually count toward your deductible too. So if you’re paying $120 for therapy and $40 for your antidepressant, both are eating into your deductible. That’s why tracking every expense matters. Some people don’t know that copays after the deductible also vary—some plans charge $20 per session, others $50. And if you switch therapists or go out-of-network? You might pay even more.

Here’s the thing: knowing your deductible isn’t just about budgeting. It’s about making sure you don’t skip care because you’re afraid of the bill. If you’re paying for therapy out of pocket, ask your provider if they offer sliding scale fees. Check if your employer has an EAP (Employee Assistance Program)—many give free sessions. Some telehealth platforms charge flat monthly rates, which can be cheaper than paying per visit. And if you’re on Medicare or Medicaid, therapy coverage is usually better, but you still need to know the rules.

You’re not alone in feeling confused. Insurance plans are built to be complicated. But you don’t need to be an expert to get the care you need. Start by calling your insurer and asking: "What’s my therapy deductible? Is it separate from my medical deductible? How much do I pay per session after I meet it?" Write it down. Keep receipts. Track every payment. That way, you’ll know exactly when coverage kicks in—and you won’t be surprised by a $600 bill at the end of the month.

The posts below cover real stories and practical advice from people who’ve been there. You’ll find guides on how to negotiate therapy costs, what to do if your insurance denies coverage, how to find low-cost counselors, and why some people pay less than others—even with the same plan. There’s also info on how medications, insurance changes, and even tax credits can help reduce your burden. No fluff. Just clear, usable info to help you get the care you deserve without going broke.