Insurance Copay: What It Is, How It Works, and How to Manage Costs

When you visit the doctor or pick up a prescription, you might hear the term insurance copay, a fixed amount you pay for a covered health service before your insurance kicks in. Also known as a copayment, it’s one of the most common ways health plans shift part of the cost directly to you. It’s not a percentage of the bill—it’s a flat fee. Maybe $20 for a doctor’s visit, $10 for a generic pill, $50 for an ER trip. Sounds simple, right? But if you’re juggling multiple meds or frequent appointments, those $20s add up fast—and they can make you skip care you actually need.

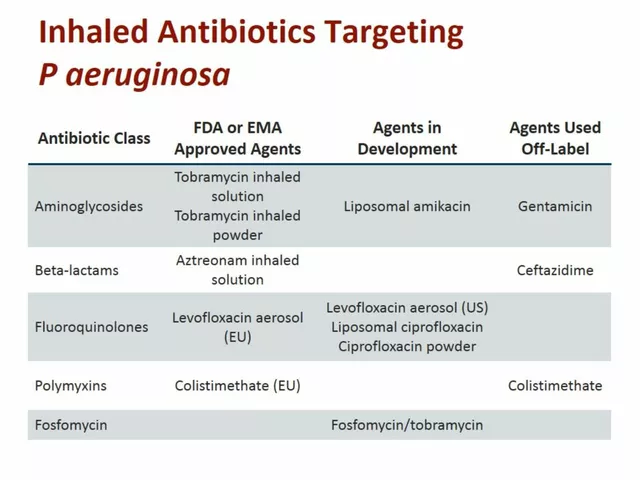

Here’s the catch: a low monthly premium often means a higher insurance copay, the fixed amount you pay out-of-pocket for each medical service. And if your plan has a deductible, you might pay full price until you hit that number, then start paying copays. That’s why people end up confused: they thought their plan was cheap, but now every visit costs more than they expected. Prescription copay, the fixed fee you pay for each filled medication can be even trickier—some plans charge different copays for generics, brand names, or tiered drugs. A $5 copay for metformin? Great. A $150 copay for your thyroid med? Not so much.

And it’s not just about the number. Where you get care matters too. Going to an out-of-network specialist might mean no copay at all—just a huge bill you have to pay upfront. Meanwhile, your in-network pharmacy might offer a $10 copay for the same drug your neighbor pays $75 for elsewhere. That’s why knowing your plan’s formulary and network is as important as knowing your copay amount. You can’t control the price of care, but you can control where and how you get it.

Some people think copays are just a nuisance. But they’re also a tool. Insurance companies use them to discourage unnecessary visits. And for you? They’re a signal—when you see a high copay, it’s time to ask: Is there a cheaper alternative? Can I switch to a generic? Does my plan offer mail-order for maintenance meds? A lot of the posts below break down real cases—people who saved hundreds by switching pharmacies, negotiating with their insurer, or even using patient assistance programs for high-cost drugs. You don’t need to be a healthcare expert to make smarter choices. You just need to know what questions to ask.

Below, you’ll find real stories and practical guides on managing medication costs, understanding insurance fine print, and avoiding surprise bills. From how to challenge a high copay to what to do when your insurance denies coverage, these posts give you the tools to take back control—not just of your health, but of your wallet.